Scaling FinTech with Confidence and Control

Whether you're preparing for your next funding round or building systems to support rapid growth, QTA helps FinTech leaders align strategy, infrastructure, and compliance without sacrificing speed.

Scaling FinTech with Confidence and Control

Whether you're preparing for your next funding round or building systems to support rapid growth, QTA helps FinTech leaders align strategy, infrastructure, and compliance without sacrificing speed.

How We Help

From early-stage disruptors to scaling platforms, we support FinTech teams with the capital strategy, operational structure, and reporting tools they need to thrive in a regulated, fast-moving landscape.

Investor-ready capital models and forecasts

Build confidence with clear, audit-ready models that communicate your growth story and financial potential.

Payments, KYC, and API workflow mapping

Streamline how your platform functions — and ensure your infrastructure supports scale, compliance, and integration.

Digital onboarding and client journey automation

Accelerate acquisition and improve retention by designing frictionless user journeys powered by smart automation.

Dashboards for compliance, revenue, and runway

Give your leadership team and investors real-time visibility into performance, risk, and financial trajectory.

How We Serve Diverse Sectors

Every industry is navigating transformation — from tightening margins and investor demands to rapid digitization and regulatory shifts. At QTA, we meet each client where they are, with AI-powered solutions grounded in commercial expertise. From agriculture to infrastructure, our work is customized, measurable, and built to drive outcomes.

Sectors

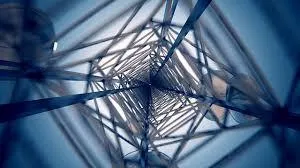

Infrastructure

Streamlining complex project delivery with AI-enhanced oversight and stakeholder alignment.

Agriculture

Boosting yield predictions, supply chain visibility, and capital access for agri-enterprises.

Renewable Energy

Accelerating finance and deployment of clean energy projects with real-time AI modeling.

FinTech

Driving faster funding, smarter compliance, and automated client onboarding for financial innovators.

Mining

Supporting resource operations with data-led decision systems and investor-grade reporting.

Power

Enhancing grid intelligence, risk mitigation, and operational transparency through automation.

Telecoms

Improving network strategy and customer lifecycle value via predictive AI fr

Real Estate

Elevating asset visibility, project financing, and investor readiness with dynamic dashboards.

Our Mission & Philosophy

Mission

To deliver transformational outcomes by fusing elite advisory with AI-powered execution.

Vision

A world where strategic advice is actionable, data-backed, and instantly deployable.

Values

Integrity — We do what’s right, not what’s convenient. Intelligence — We bring clarity to complexity. Innovation — We use technology to extend human capability. Impact — We focus on meaningful results, not vanity metrics.

See What Our Customers Have to Say

“QTA’s service has been a game-changer for our business and growth.”

They exceeded all my expectations. From the beginning, their professionalism, expertise, and commitment to delivering exceptional results stood out. QTA’s in-depth market research provided valuable insights, shaping our strategy effectively.

John Matthews

Finance Manager at BrightWave

Have any Questions?

No hesitation, we can help you with a free Consultation

COMPANY

SECTORS

CUSTOMER SERVICE

NEWS

LEGAL

Copyright 2025. QTA. All Rights Reserved.